Budgeting Automation: Pay it Down & Save it Up

Join 3 million+ people who have used MyEarnUp to crush debt, grow savings, and cut interest fees!♦

Join the EarnUp Community Today & Get Your Special Offer!

We will waive the $15 Monthly Fee for your first three months. Thereafter, you pay just $15 per month.* No matter how many loans you add – auto, mortgage, student loans, and more – your monthly fee stays the same!

*This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

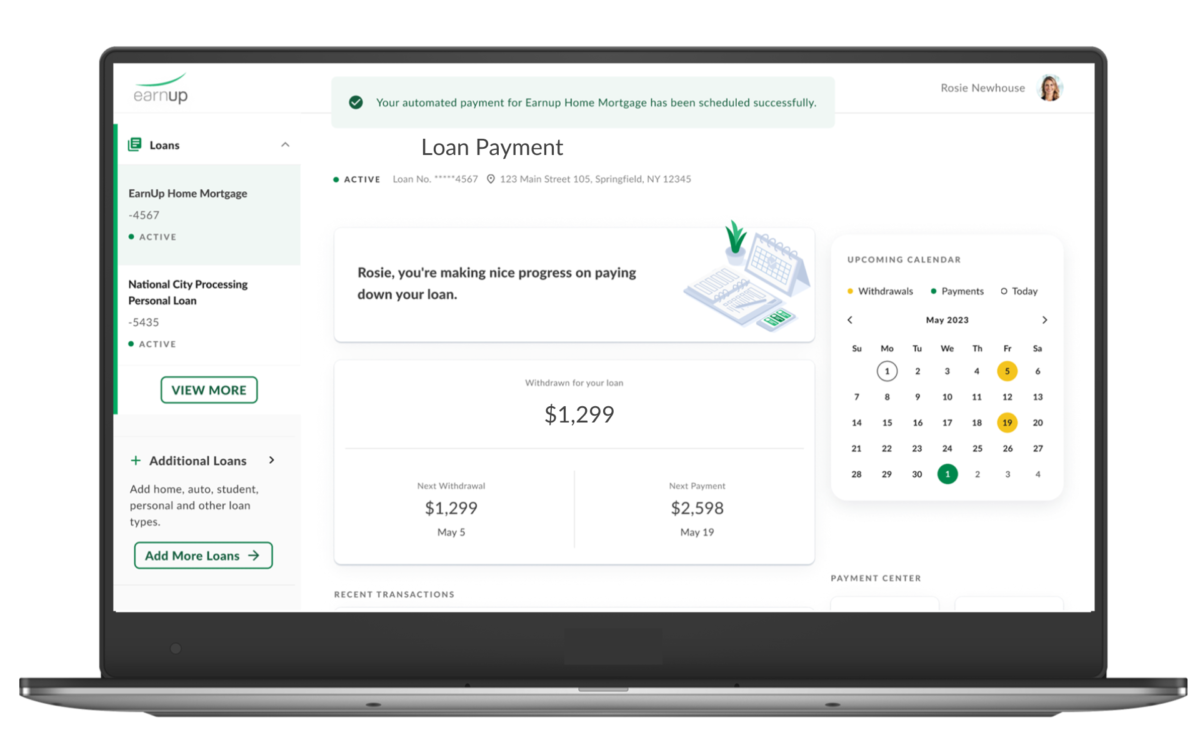

How MyEarnUp Works!

Now it’s ridiculously easy to manage all your debt repayments from one place. Here’s how it works:

- Sign-up & add as many loans as you like – including, student, auto, personal, mortgage, and even credit cards! It doesn’t matter if they are from different lenders.

- Select your custom payoff plan. We offer several flexible payoff options that break your monthly payments into more manageable withdrawals, including weekly, bi-weekly, and more.

- Sit back and let MyEarnUp do the work. Throughout the month, we withdraw portions of your total payment(s). Then, on the due date, we make the entire payment on your behalf.*

DIY budgeting apps can't compete

MyEarnUp simplifies your budget, making it easy to manage all your debt from one platform.

Our automated debt payoff tool aligns your repayment to your schedule and budget – without new loans or balance transfers.¹

Low, flat monthly program fee.

Unlimited platform use.

Say Goodbye to Credit Card Debt Stress

without taking on additional loans or adding another credit card to your wallet!

With MyEarnUp, you can enjoy the ease of flexible credit card payment options and a simpler path to debt freedom.

Concerned about Student Loan payments?

We can help you put those student loan payments on autopilot, and save thousands in interest.¹

Debt doesn't have to rule your life

Savings Calculator

Use this calculator to estimate interest savings and loan payoff acceleration when using a bi-weekly schedule. Your actual savings will differ.*

Note: There is no change to interest rates or loan terms. This is not a debt consolidation tool.**

Getting started is easy

No long-term commitment. No strings attached.

Enroll

Takes ~5 Minutes

(have info ready)

Add Debt

Credit Card, Mortgage, Auto, Student,

or Personal Loans ok!

Link Bank Account

Connection Secured

by Plaid

Set Schedule

Sync to Payday or

Other Schedule

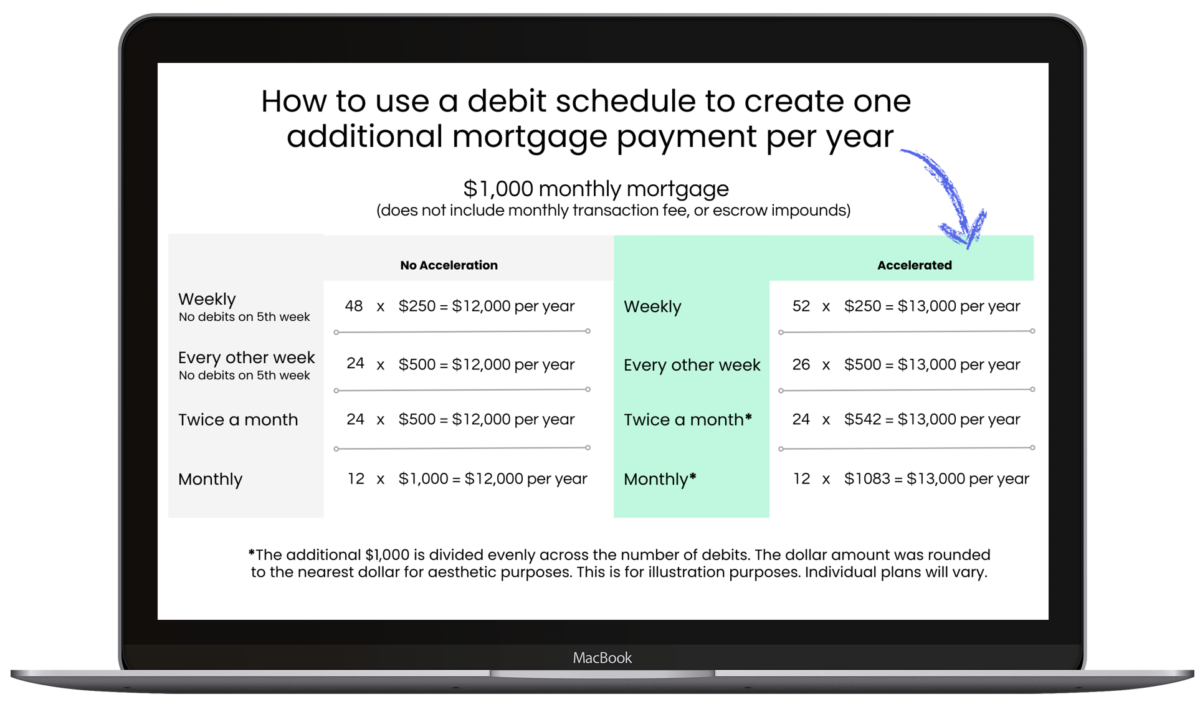

Are You Using the Power of 13 to Accelerate Debt Payoff?

When you add optional Acceleration to your custom withdrawal schedule, you can pay off your loan faster and pay less in interest.¹

Check Google or BBB for feedback²

Insights, news & more

What's New?

Learn how to start paying student loans after college. Understand grace periods, repayment plans, and strategies to manage your student loan debt effectively. Explore options like income-driven repayment and loan forgiveness programs as you prepare to start paying student loans.

Discover the far-reaching impact of paying off debt on your finances, mental health, relationships, and career opportunities. Learn how to transform your life.

Struggling with debt? This comprehensive guide provides actionable steps on how to pay off debt in 2024, covering budgeting, repayment strategies, FAQs, and more. Learn practical tips and real-life experiences to achieve financial freedom.

Discover romantic and budget-friendly ideas on how to save money Valentine's Day this year. Learn how to plan, get creative with DIY gifts and experiences, make free activities meaningful, and still make Valentine’s Day special and magical.

Should You Pay Off Debt or Save? Best Strategies Revealed

Should you pay off debt or save? This guide dives into factors like interest rates, emergency funds, and budgeting to help you make informed financial decisions to achieve freedom.

How to Start Paying Student Loans Without Stress

Learn how to start paying student loans after college. Understand grace periods, repayment plans, and strategies to manage your student loan debt effectively. Explore options like income-driven repayment and loan forgiveness programs as you prepare to start paying student loans.

Transformative Impact of Paying Off Debt: A Comprehensive Guide

Discover the far-reaching impact of paying off debt on your finances, mental health, relationships, and career opportunities. Learn how to transform your life.

How to Pay Off Debt: Smart Strategies for Financial Freedom

Struggling with debt? This comprehensive guide provides actionable steps on how to pay off debt in 2024, covering budgeting, repayment strategies, FAQs, and more. Learn practical tips and real-life experiences to achieve financial freedom.

Save Money Valentine’s Day: Budget-Friendly Love Tips

Discover romantic and budget-friendly ideas on how to save money Valentine’s Day this year. Learn how to plan, get creative with DIY gifts and experiences, make free activities meaningful, and still make Valentine’s Day special and magical.

You may have read about us

Disclosures

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

² Testimonials are individual experiences and results vary.

♦ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*This analysis is an estimate only. This illustrative example demonstrates the reduction in mortgage payments and the interest saved by opting into biweekly accelerated payments. Interest and loan term reduction are net of EarnUp’s Program fees and are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

This illustration has been simplified by 1) assuming a standard escrow value and 2) no change in the current monthly payment.

** Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

***NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.