Conquer Debt Without Cramping Your Style

More than 3 million people have simplified the path to their financial goals and saved thousands in interest fees. Now, it’s your turn!

The basics

Now, it’s ridiculously easy to manage all your debt repayments from one place. Here’s how it works:

- Sign-up & add as many loans as you like – including, student, auto, personal, mortgage, & even credit cards! It doesn’t matter if they are from different lenders.

- Select your custom payoff plan. We offer several flexible payoff options that break your monthly payments into more manageable withdrawals, including weekly, bi-weekly, and more.

- Sit back and let MyEarnUp do the work. Throughout the month, we withdraw portions of your total payment(s). Then, on the due date, we make the entire payment on your behalf.*

How to outsmart your loan debt

Use any combo of the two options below to fast track your loan payoff and save in interest fees.¹

Opt in for Acceleration

Use the extra weeks in the year

to pay extra money toward principal²

Option 1: 52 weekly withdrawals equal to 1/4 of your monthly payment = the equivalent of one additional payment each year!

Option 2: 26 bi-weekly withdrawals equal to 1/2 of your monthly payment = the equivalent of one additional payment.

Increase Withdrawal Amounts

On demand update to individual withdrawals

Increase your withdrawal amount one time, every time, or every now & then – the choice is yours.

You can use the extra to pay toward your credit card debt, which lowers your overall balance, fast tracks payoff, and saves in interest fees.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

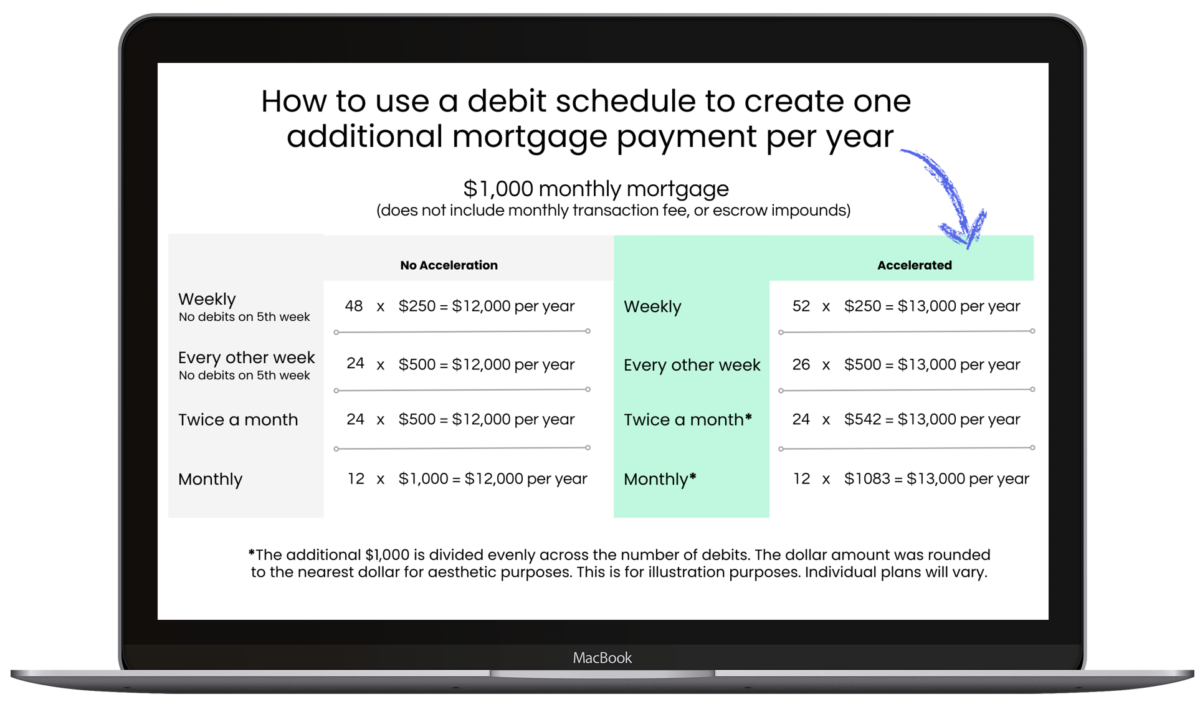

Why 13 is a lucky number

When you choose an Acceleration program, your withdrawal amounts to one additional loan payment each year. Use the extra money to pay toward principal.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made toward the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.<

Ditch Your Autopay for a Smarter Way!

Tired of the same old autopay routine? MyEarnUp kicks it up a notch by giving you the flexibility to manage all your loans in one spot and break all your payments into smaller, more manageable amounts.

Forget the cookie-cutter approach – you call the shots and customize your payoff plan to save time and money on your terms.

Or, give Dani a call to enroll by phone (888) 905-0155 (M – F, 6:00 – 6:00 PST)

Check Google or BBB for feedback³

Disclosures

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

² In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

³ Testimonials are individual experiences and results vary.

* Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

**NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.