Knowing your average monthly expenses is the first step towards financial freedom. It allows you to budget, save, and ultimately, make smarter financial moves. However, grappling with this can often feel overwhelming. In this blog post, you’ll learn how to calculate your average monthly expenses and use that knowledge to your advantage.

Understanding Average Monthly Expenses

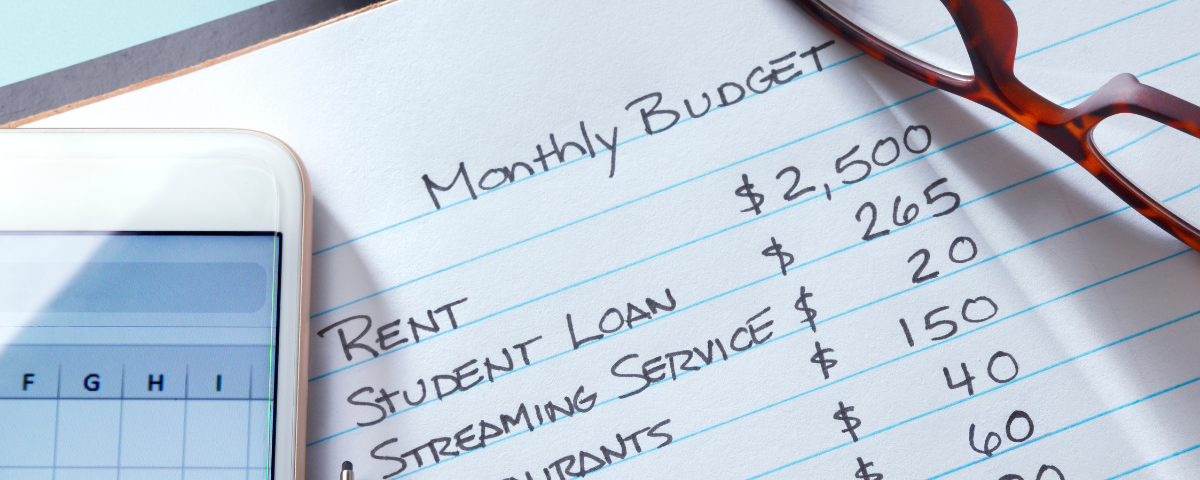

Average monthly expenses encompass everything you spend money on each month. Some of these costs, like your rent or mortgage, are fixed and recur regularly. Other expenses, like dining out or entertainment, vary.

To figure out your average monthly expenses, track your spending for a few months or gather your bank statements. Categorize where your money goes using common spending categories. These include housing, transportation, food, utilities, healthcare, debt repayment, entertainment, and personal care.

Factors Affecting Average Monthly Expenses

Several factors can influence your average monthly expenses. Where you live, your household size, and even personal spending habits significantly impact your spending.

For instance, someone living in a large city will likely have higher housing costs than someone in a rural area. Having a family inevitably leads to increased living expenses, such as groceries, childcare, and education. Being mindful of these factors empowers you to take steps towards controlling your spending.

Breaking Down Typical Average Monthly Expenses in the US

To get a clearer picture, it helps to look at a breakdown of common monthly costs for individuals and families in the US. Keep in mind that your actual average American household expenses may be higher or lower based on several factors. Use this table to understand the range of these average expenses to see where you stand.

| Category | Average Cost (Individual) | Average Cost (Family of 4) |

|---|---|---|

| Housing | $1,000 – $2,500 | $2,000 – $4,000+ |

| Transportation | $500 – $1,000 | $1,000 – $2,000+ |

| Food | $300 – $500 | $800 – $1,200+ |

| Utilities | $200 – $400 | $400 – $800+ |

| Healthcare / Health Insurance | $300 – $500+ | $800 – $1,500+ |

| Debt Repayment | $500 – $1,000+ | $1,000 – $2,000+ |

| Entertainment | $100 – $300 | $300 – $600+ |

| Personal Care | $50 – $200 | $150 – $400+ |

| Total | $2,950 – $6,000+ | $6,450 – $12,500+ |

How Has Inflation Impacted Living Expenses?

Over the past few years, inflation has reared its ugly head, impacting the cost of goods and services across the board. This means your monthly living expenses have likely increased, putting a strain on your personal finances.

Let’s take a look at how inflation is impacting common household budget categories:

- Housing: Whether you’re renting or paying a mortgage, housing costs tend to take the biggest bite out of your budget. Unfortunately, housing affordability has declined as inflation rises, making it more expensive to keep a roof over your head.

- Transportation: While gas prices can fluctuate, we’ve seen how dramatically they can impact transportation costs. Add in the rising costs of used cars and new vehicles, and getting from point A to point B is becoming more expensive.

- Groceries: That trip to the grocery store is putting a bigger dent in your wallet than it used to. Food prices are increasing, making it more challenging to stick to your grocery budget.

- Utilities: From your electricity bill to your internet service, you’re likely feeling the pinch of inflation on your utility costs as well.

- Healthcare: Healthcare expenses are notorious for rising, and inflation only exacerbates the problem.

Creating a Realistic Monthly Budget

Now, let’s discuss how to create a budget that works for you. First, make a list of all your income sources. This should include your salary, wages, or any other income streams.

Then subtract your average monthly expenses from your total income to find your net income. This is the detailed breakdown we discussed in the previous section. If you find yourself with more money coming in than going out, you’re in great shape.

Fixed Expenses

Fixed expenses are the bedrock of your budget. They are the costs that stay relatively the same from month to month, making them easy to anticipate and plan for. Common examples of fixed expenses include:

- Rent or mortgage payments

- Car payments

- Student loan payments

- Insurance premiums (health, auto, renter’s/homeowner’s)

- Subscription services (streaming, gym, etc.)

Variable Expenses

Unlike fixed expenses, variable expenses tend to fluctuate. These are the costs that change from month to month based on your usage or consumption habits. While they can be harder to predict, tracking variable expenses is crucial for managing your cash flow. Examples of variable expenses include:

- Groceries

- Utilities (electricity, gas, water)

- Transportation (gas, public transit, tolls)

- Dining out

- Entertainment

- Clothing

- Travel

- Gifts

Then, Allocate this extra cash towards your savings goals, like building an emergency fund. You can also use it for debt repayment, such as paying down a personal loan or making extra payments towards a student loan. On the flip side, if your average monthly expenses exceed your income, identify areas where you can reduce spending. Little changes, like brewing your own coffee instead of buying it daily, can make a real difference over time.

Why Knowing Your Average Monthly Expenses Matters

Why is understanding your average monthly expenses so crucial for managing your money? Well, first and foremost, it provides a crystal-clear picture of your cash flow, allowing you to see where your money is actually going. Additionally, it empowers you to see how much money you’re spending each month on things like credit cards.

When you have a firm grip on your average monthly expenses, it empowers you to craft a budget. This budget will align with your financial aspirations. Your aspirations can be anything, such as saving for a down payment on a home, opening a high-yield savings account, eliminating debt, or simply achieving a sense of financial security.

Conclusion

Managing average monthly expenses can initially feel daunting but it doesn’t have to be. Knowledge, coupled with consistent tracking and a dash of mindful spending, paves the path to achieving your financial objectives. It can even bring a sense of calm in our often-chaotic financial lives.

Frequently Asked Questions About Average Monthly Expenses

What is a normal amount of monthly expenses?

The definition of “normal” monthly expenses varies widely depending on individual circumstances such as location, family size, and income level. Generally, essential expenditures include housing (rent or mortgage), utilities, groceries, transportation, insurance, and healthcare. For most households in the United States, these can range from 50% to 70% of their total income. Discretionary spending on entertainment, dining out, and other non-essentials will vary further based on personal financial management and priorities.

Average Monthly Expenses for One Person

What is the average monthly expenses for one person?

The average monthly expenses for one individual can vary significantly based on location, lifestyle, and personal circumstances. In general, a typical range in the United States could be between $2,000 to $3,500. This estimation includes costs such as housing, food, transportation, healthcare, and miscellaneous necessities.

Realistic Monthly Budget

What is a realistic monthly budget?

A realistic monthly budget varies based on individual income, expenses, and financial goals. Generally, it should allocate funds for necessities like housing, utilities, groceries, and transportation; discretionary spending such as entertainment and dining out; savings for emergencies and future plans; and debt repayment if applicable. Effective budgeting often follows the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% towards savings and debt repayment.

What is the average living expenses per month in the US?

The average monthly living expenses in the United States vary significantly based on location, household size, and lifestyle. However, a general estimate for a single person’s basic monthly costs (including housing, food, transportation, and utilities) ranges from $2,000 to $3,500. Families typically face higher expenses due to increased needs for housing and food.