Conquer Your Mortgage on Your Terms!

What happens when you pair your PHH mortgage & EarnUp? You unlock payment flexibility, open up opportunities to save thousands on interest, and accelerate your journey to a mortgage-free life!

It's More Than Autopay!

Reimagine Your Mortgage Repayment

How much could you save? EarnUp not only simplifies your mortgage pay off, but it can help you crush debt in no time!

On a $400,000 mortgage at 6.5%, you could save $100k+ and shave almost 6 years off your repayment!**

Smaller Payments = Bigger Savings

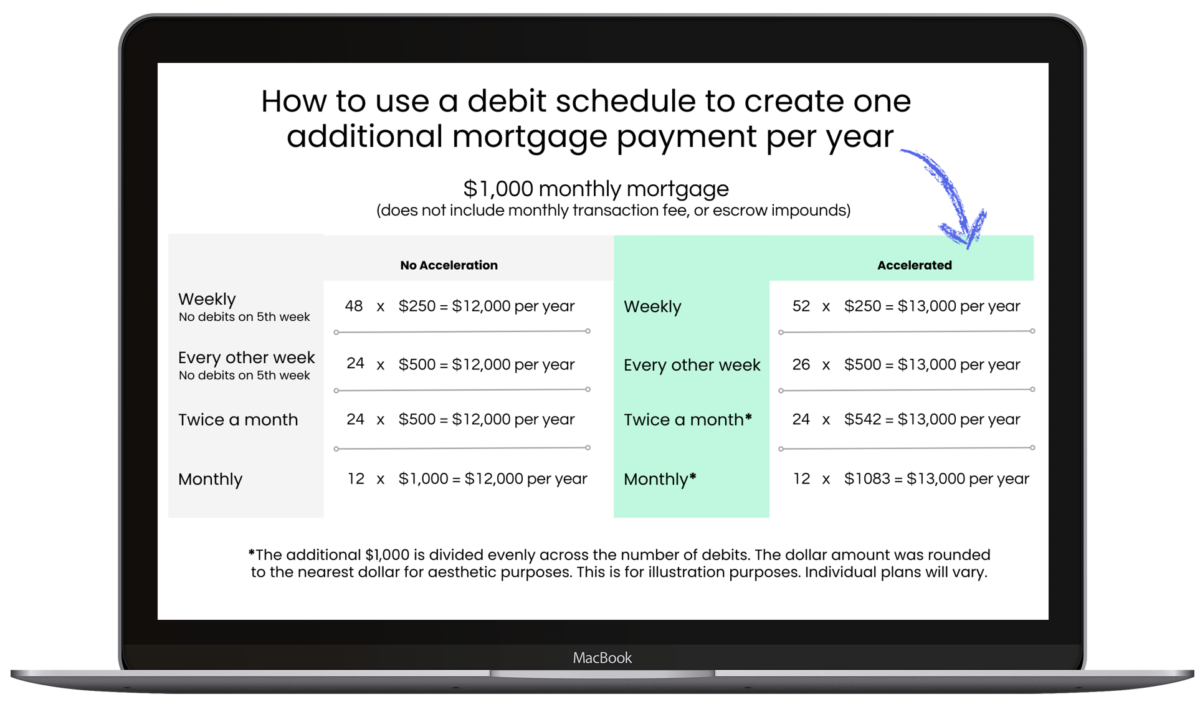

Seem too good to believe? It’s true! When you opt in for a weekly or bi-weekly schedule or add extra money to your monthly withdrawal with our acceleration program, your withdrawals can amount to one additional loan payment each year.³

Getting started is easy

It’s easy as 1-2-3 to manage all your debt repayments from one place with EarnUp.

Enroll

Takes ~5 Minutes

(have info ready)

Add Mortgage

This can be your primary home, an investment property, or HELOC

Link Bank Account

Connection Secured

by Plaid

Set Schedule

Sync to Payday or

Other Schedule

We offer multiple ways to make your payment.

Choose the one that’s right for you!

Schedule one debit monthly

- Each payment is half the regular monthly amount.

- Add optional additional principal to your payment.

Schedule one debit weekly

- Each payment is one quarter of the regular monthly amount.

- Add optional additional principal to your payment.

Schedule bi-weekly debits

Save money by paying your mortgage down faster by making one extra payment a year.

- Each payment is half the regular monthly amount.

- Choose two different payment dates per month.

- At any time, increase debit amount to pay down principal faster.

- Twice a year you’ll make three payments in a month, resulting in one extra principal payment a year.

- In your first month, you’ll make your regular current month’s payment plus two half payments.

- After your first month, you’ll make two half payments every other week.

Schedule twice-a-month debits

Budget your payment amounts by splitting your monthly payment amount into two payments.

- Each payment is half the regular monthly amount.

- Choose two different payment dates per month.

- At any time, increase the debit amount to pay down principal faster.

Choose a Weekly or Bi-Weekly Plan

Use the extra weeks in the year to

pay extra money toward principal²

Option 1: 52 weekly withdrawals – each withdrawal is 1/4 your regular monthly amount. 4 times a year you make 5 withdrawals in a month = 1 extra payment a year.

Option 2: 26 bi-weekly withdrawals – each withdrawal is 1/2 your regular monthly amount. Twice a year you’ll make 3 withdrawals in a month = 1 extra payment a year.

Increase Withdrawal Amounts

Add optional additional principal to your

withdrawal for increased interest savings²

Increase your withdrawal amount one time, every time, or every now & then – the choice is yours.

You can use the extra to pay toward your highest interest debt to strategically lower your overall balance, fast track payoff, and save in interest fees.²

Check Google or BBB for feedback⁴

Disclosures

¹ This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

³ In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

⁴ Testimonials are individual experiences and results vary.

♦ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

** The figures presented are for informational purposes only, and individual results may vary based on personal financial situations, market conditions, and other factors.*Figures are for illustrative purposes only. See site for details.

***NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.