¹ This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

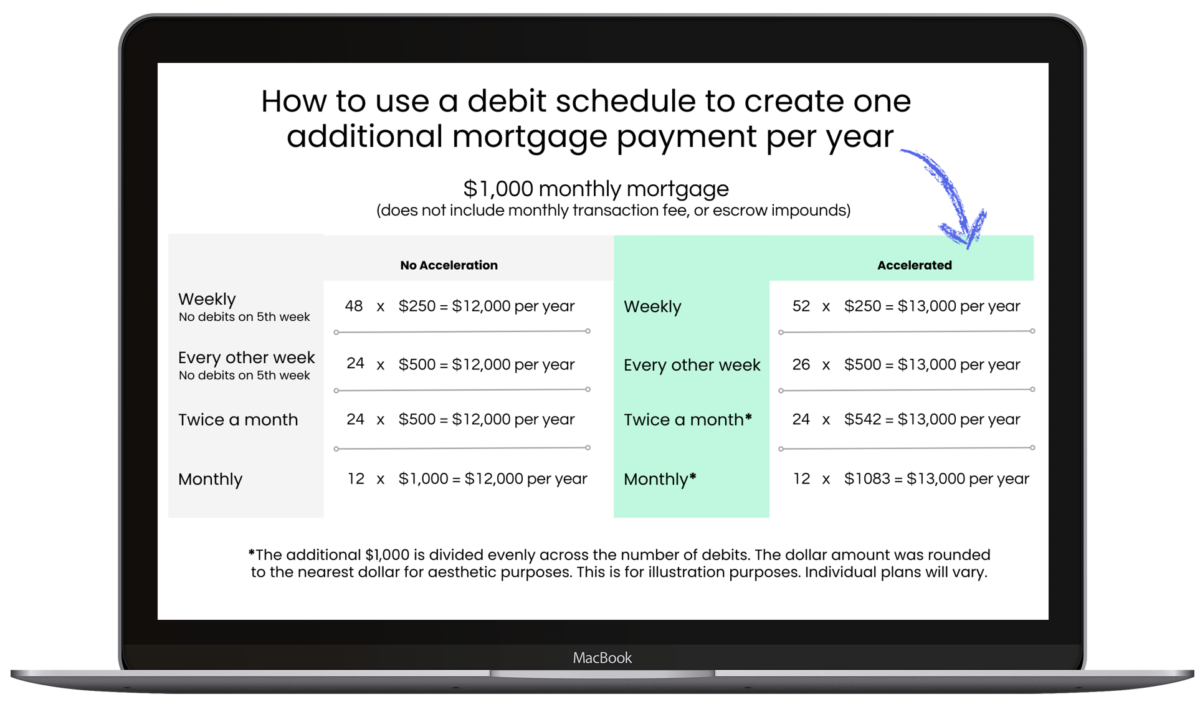

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

³ In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

⁴ Testimonials are individual experiences and results vary.

♦ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

**NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.