Discover practical ways to cope with financial stress, from budgeting to self-care. Expert tips to help you regain control of your finances and reduce anxiety.

Rejoin MyEarnUp today and we will waive the $15 Monthly Fee for your first six months. Thereafter, you pay just $15 per month.* No matter how many loans you add – auto, mortgage, student loans, and more – your monthly fee stays the same!

AND, if you re-enroll by March 29, 2024, we will send you a $25 gift card!**

*This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

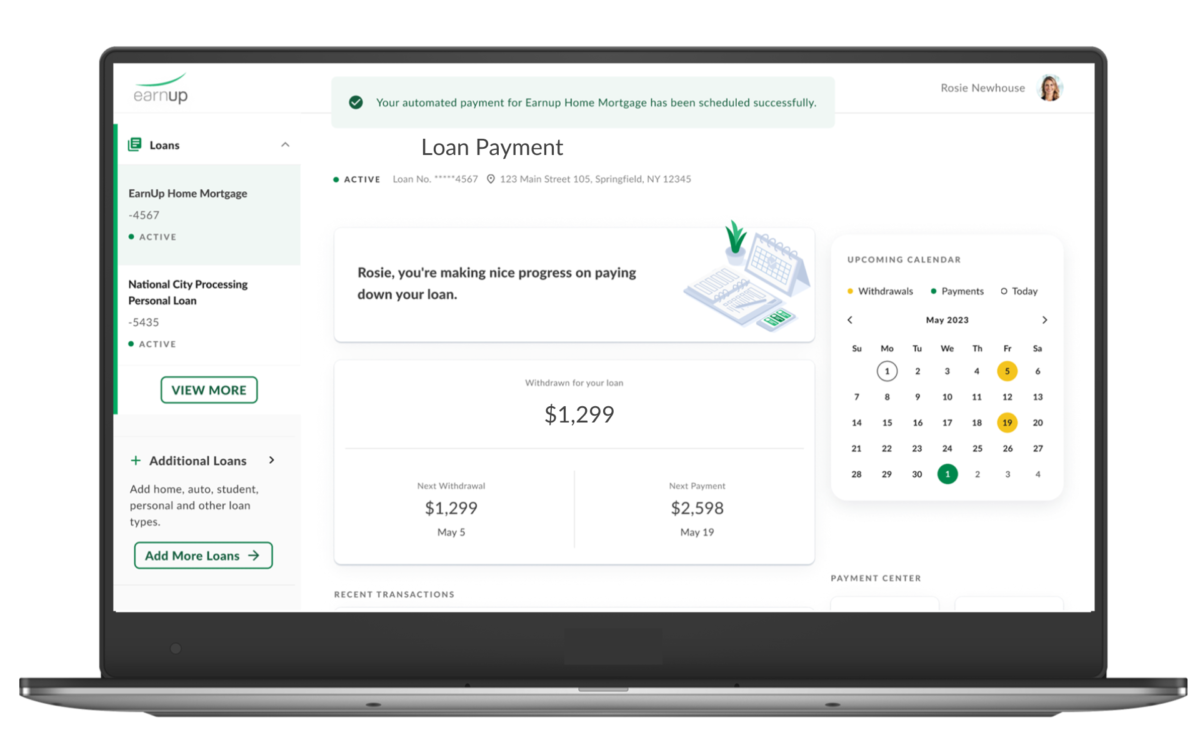

MyEarnUp simplifies your budget, making it easy to manage all your debt from one platform.

Our automated debt payoff tool aligns your repayment to your schedule and budget – without new loans or balance transfers.

We can help you put those student loan payments on autopilot and save thousands in interest.¹

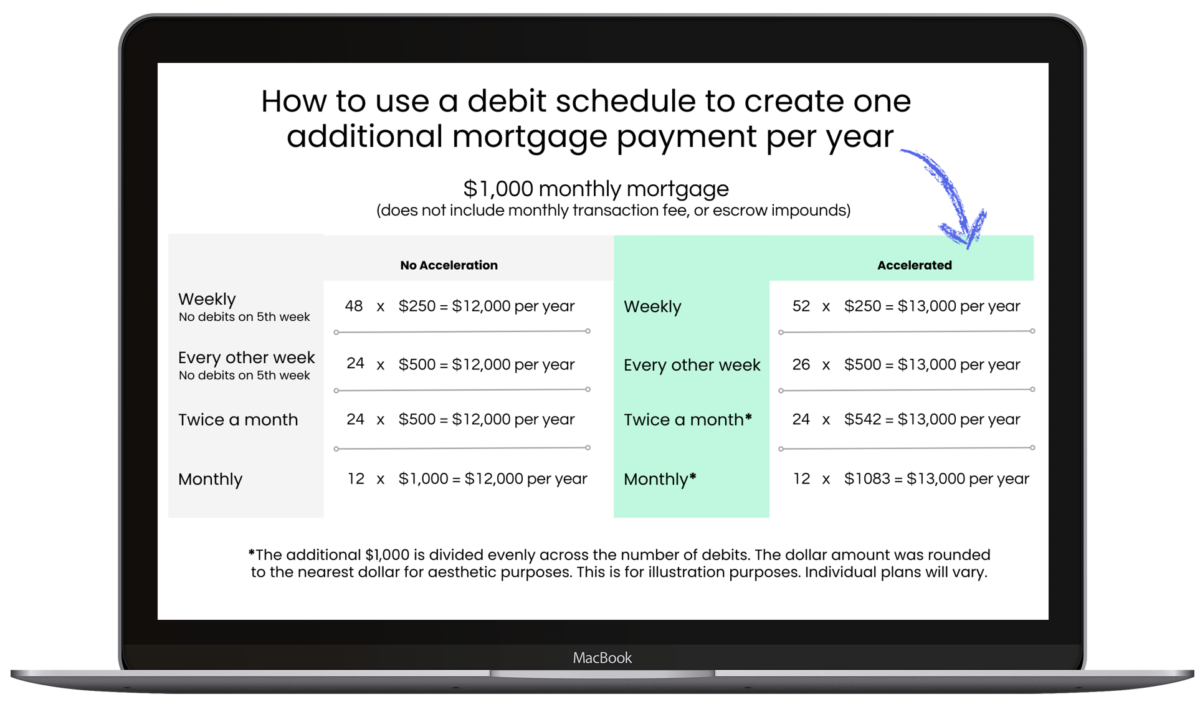

Outsmart your debt by syncing your repayment with your paydays — whether weekly, bi-weekly, or monthly — helping to fast-track your payoff and cut down on interest.

And you can simplify the whole shebang with our ‘set & forget’ auto withdrawal schedule, which makes it easy to stay on top of your financial commitments.♦

Use this calculator to estimate interest savings and loan payoff acceleration when using a bi-weekly schedule. Your actual savings will differ.

Note: There is no change to interest rates or loan terms. This is not a debt consolidation tool.*

No long-term commitment. No strings attached.

Enroll

Takes ~5 Minutes

(have info ready)

Add Loans

Mortgage, Auto, Student,

or Personal Loans ok!

Link Bank Account

Connection Secured

by Plaid

Set Schedule

Sync to Payday or

Other Schedule

When you add optional Acceleration to your custom withdrawal schedule, you can pay off your loan faster and pay less in interest.¹

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Discover practical ways to cope with financial stress, from budgeting to self-care. Expert tips to help you regain control of your finances and reduce anxiety.

**Struggling with $10,000 in credit card debt? This comprehensive guide covers how to pay off 10,000 credit card debt quickly, using proven strategies, smart budgeting tips, and practical advice for taking control of your finances.**

Learn how to pay off debt when living paycheck to paycheck. Our guide gives you effective strategies, from budgeting to increasing income, that empower you to become debt-free and financially secure.

Discover practical tips for managing financial stress, from budgeting to seeking professional help. Learn how to take control of your finances and reduce money-related anxiety.

Struggling with $5,000 in debt? Our guide covers everything you need to know about how to pay off 5,000 in debt and offers proven strategies for a fresh start. Learn budget tips, debt repayment plans, debt consolidation tactics and access helpful resources!

Discover practical ways to cope with financial stress, from budgeting to self-care. Expert tips to help you regain control of your finances and reduce anxiety.

**Struggling with $10,000 in credit card debt? This comprehensive guide covers how to pay off 10,000 credit card debt quickly, using proven strategies, smart budgeting tips, and practical advice for taking control of your finances.**

Learn how to pay off debt when living paycheck to paycheck. Our guide gives you effective strategies, from budgeting to increasing income, that empower you to become debt-free and financially secure.

Discover practical tips for managing financial stress, from budgeting to seeking professional help. Learn how to take control of your finances and reduce money-related anxiety.

Disclosures

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

² Testimonials are individual experiences and results vary.

♦ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

** This is a limited time Gift Card offer. This offer has no cash value and is subject to change or cancellation with notice. (This offer and receipt of a Gift Card is subject to EarnUp privacy policy and terms and conditions. Gift cards will be issued upon the first debit of your account and will be sent to the email you used during enrollment; provided you submit your signed authorization form no later than March 29, 2024.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

PayItOff is a feature of MyEarnUp that allows you to locate your loans. Please complete the form below to access our student loan tool and receive comprehensive information regarding your student loan account and savings opportunities.

Pay it Forward, Keep it a No Cost Feature!

We rely on voluntary payments from our users to continue offering our loan location service at no cost. After you find your loans, we will contact you with information on how you can make a voluntary payment to pay it forward.