Want to Break Free from Debt? Another Loan Is Not The Answer!

Taking out another loan or doing a balance transfer might seem like a quick fix, but it’s not the solution to your long-term financial freedom.

MyEarnUp offers a smarter way to optimize your existing debt payoff—without the need for new loans or complicated balance transfers.

Take the Stress Out of Debt Management

Managing debt doesn’t have to be overwhelming or complicated. Whether it’s student loans, auto loans, personal loans, or credit cards, you can manage and optimize your debt payoff in one centralized platform for just $15 per month.

Say goodbye to financial stress and hello to smarter, simpler debt management!

Track and Manage Your Loans in One Place

Easily organize student loans, mortgages, auto loans, credit cards, and personal loans from multiple lenders in one convenient dashboard.

Flexible Repayment Options That Fit Your Budget

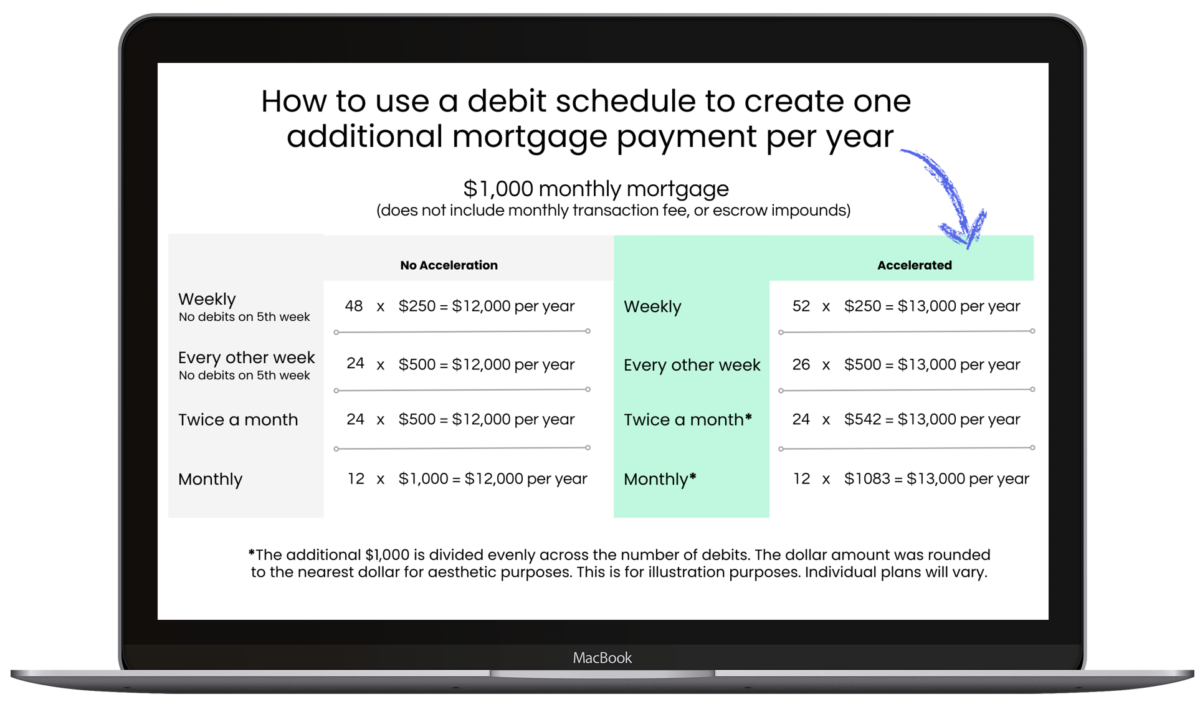

Choose from weekly, bi-weekly, or monthly debits to break down payments into manageable, automatic withdrawals.

Automated Repayments Made Simple

We collect smaller sums and ensure your full payment reaches the lender on time, so you never miss a due date.

Save Money and Pay Off Debt Faster

Boost principal payments to fast-track your payoff and save on interest with our smart repayment system.

No New Loans Required

We’re not a lender – no personal loans or balance transfers needed. Our tool offers a smart, automated way to manage your existing debt without adding more loans.

Affordable Fixed Monthly Rate

Enjoy the simplicity of a $15 monthly fee. No hidden charges, no surprises—just a straightforward, budget-friendly way to manage your loans and stay on track!

Try MyEarnUp for 3 Months with No Program Fees!

Fill out the form below to kickstart your debt payoff journey and enjoy your first 3 months with no program fees.¹ After that, continue managing your loans effortlessly for just $15 per month. Don’t miss out on this limited-time offer!

¹ This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

See How Much You Can Save With MyEarnUp

Use our interactive calculator to discover your potential savings and payoff timeline with bi-weekly payments. Your actual savings will differ.*

Note: There is no change to interest rates or loan terms. This is not a debt consolidation tool.**

Fast-Track Your Debt Freedom

Mix and match the options below to reduce interest and pay off your loan sooner.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Opt in for Acceleration

Use the extra weeks in the year

to pay extra money toward principal²

Option 1: 52 weekly withdrawals equal to 1/4 of your monthly payment = the equivalent of one additional payment each year!

Option 2: 26 bi-weekly withdrawals equal to 1/2 of your monthly payment = the equivalent of one additional payment.

Increase Withdrawal Amounts

On demand update to individual withdrawals

Increase your withdrawal amount one time, every time, or every now & then – the choice is yours.

You can use the extra to pay toward your credit card debt, which lowers your overall balance, fast tracks payoff, and saves in interest fees.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

13 Is Your New Lucky Number

When you choose an Acceleration program, your debits amount to one additional loan payment each year. Use the extra money to pay toward principal.³

³ In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

Claim Your Special Offer!

Fill out the form below to kickstart your MyEarnUp journey and enjoy your first 3 months with no program fees.¹ After that, continue managing your loans effortlessly for just $15 per month. Don’t miss out on this limited-time offer!

¹ This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

Explore Reviews on Google or BBB Before You Decide⁴

Disclosures

¹ This is a limited-time offer. This offer has no cash value. Offer is subject to change without notice.

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

³ In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

⁴ Testimonials are individual experiences and results vary.

♦ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

**NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.