Paying Off Loans Just Got Easier

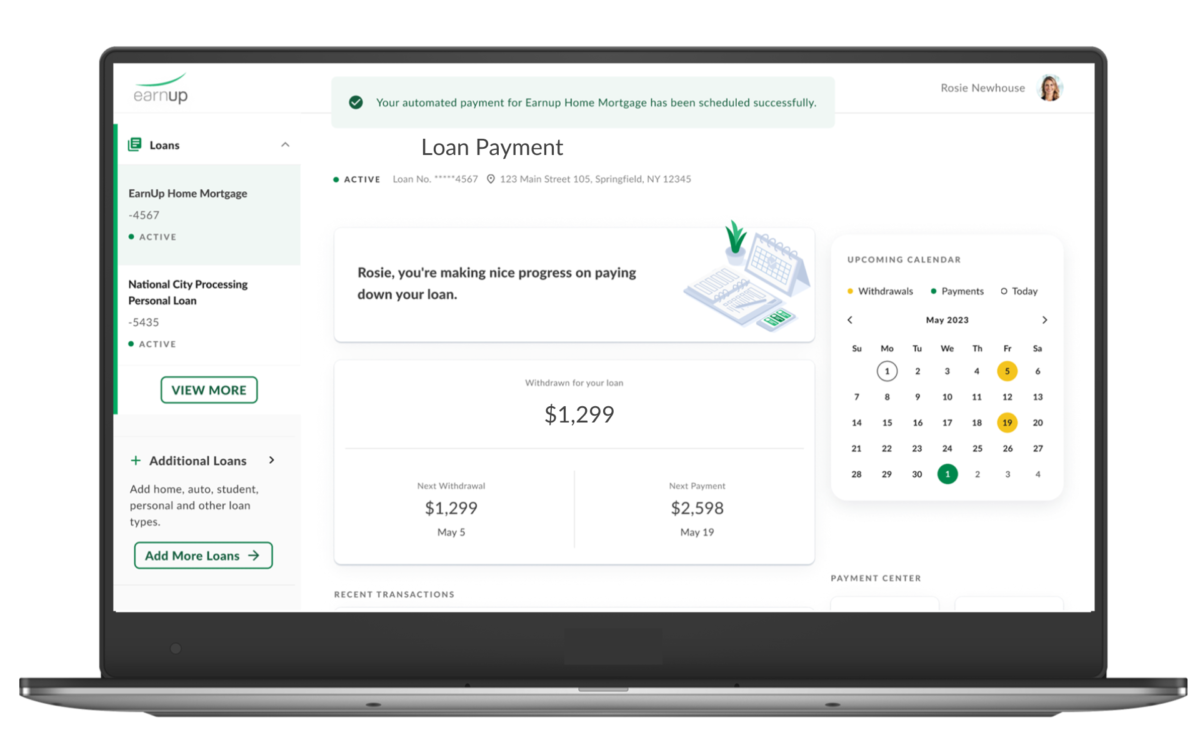

MyEarnUp automatically sets aside smaller increments of your loan payments (in 2, 3, 4, or 5 equal portions), and then makes the payment on your behalf by the due date.¹

¹ EarnUp is not a money transmitter and will not receive or hold your funds. Money transmission services are provided by partner financial institutions.

How It Works

- Connect your loans and bank account

- Set your payday schedule

- Pay down your debt

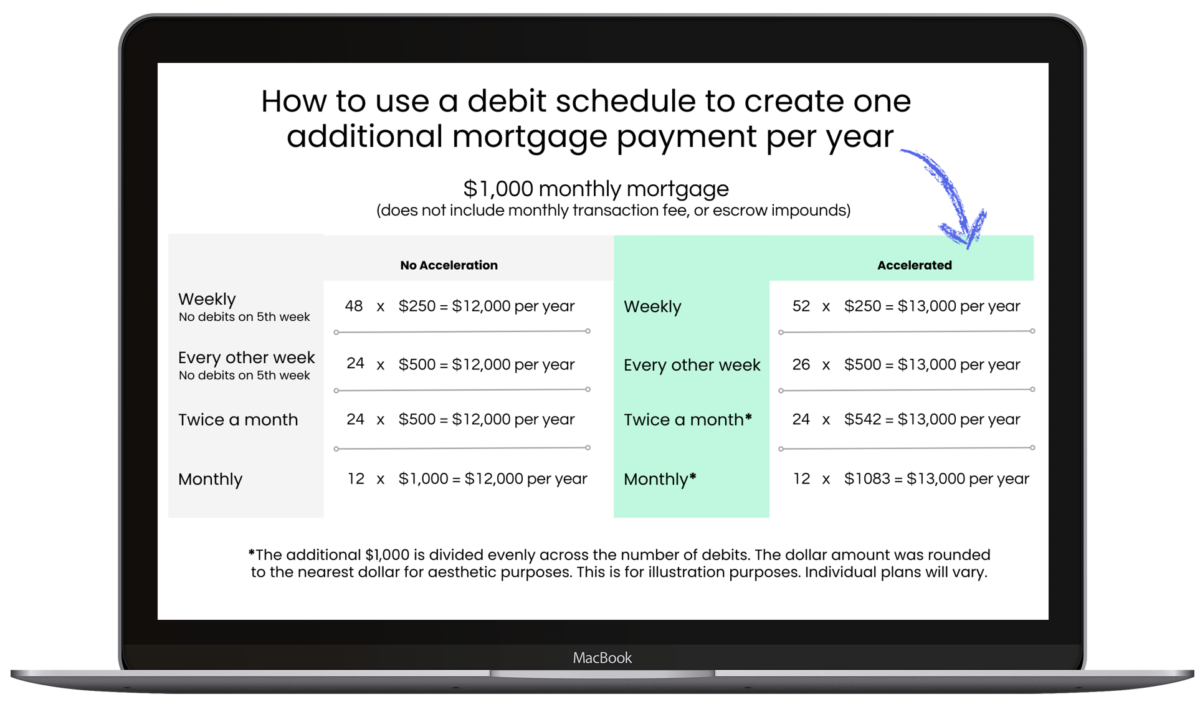

One Extra Payment Makes a Huge Difference

Opt in to Acceleration to set aside enough money to make an extra loan payment toward your principal every year. Pay down debt faster and save on interest.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Flexible Payment Toward Your Principal

Increase the amount going toward your principal whenever you want, so you can pay down debt faster and save on interest.²

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Savings Calculator

Use this calculator to estimate interest savings and loan payoff acceleration when using a bi-weekly schedule. Your actual savings will differ.*

Note: There is no change to interest rates or loan terms. This is not a debt consolidation tool.**

Automate Your Loan Payments for $15/mo⁴

- Don’t miss a loan payment

- Get out of debt faster

- Pay less in interest

⁴ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

Disclosures

¹ EarnUp is not a money transmitter and will not receive or hold your funds. Money transmission services are provided by partner financial institutions.

² Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

³ Testimonials are individual experiences and results vary.

⁴ Loan Value must stay the same. Loan must be paid with no default or payment errors on the account. You must notify EarnUp of any changes to your Escrow payment. Price is subject to change without warning.

*This analysis is an estimate only. This illustrative example demonstrates the reduction in mortgage payments and the interest saved by opting into biweekly accelerated payments. Interest and loan term reduction are net of EarnUp’s Program fees and are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

This illustration has been simplified by 1) assuming a standard escrow value and 2) no change in the current monthly payment.

** Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

***NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.