A budget-friendly way to repay your student loan debt!

We can help!

Federal Student Loan payments restarted in October. How are you tackling your loans?

Pay your student loan debt on terms that work with your monthly budget.

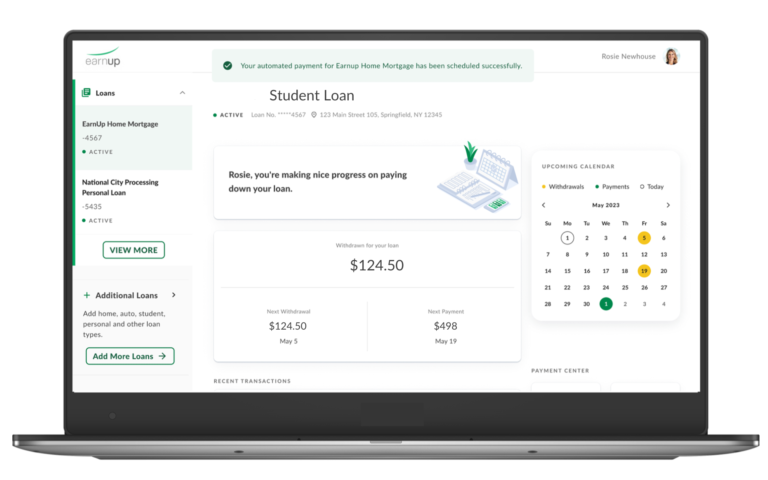

Enroll with EarnUp to split one large monthly loan payment into 2, 3, or 4 smaller incremental debits scheduled throughout the month.

You don't have to choose between an education and financial goals.

If paid over the entire 20-year loan term, interest fees could drive the total as high as the cost of a home!

You're in Control.

With EarnUp you can schedule your auto debits to sync with your weekly, bi-weekly, monthly, or semi-monthly payday schedule.

And with the option to accelerate, you could save thousands in interest fees and pay off those loans years earlier.¹

Once enrolled with a student loan, you can add your mortgage, auto, and personal loans, too!

Special Limited Time Discount

We will waive the $15 Monthly Fee for your first six months.

Thereafter, you pay just $15 per month.¹

Start with a Student Loan, then add your mortgage, auto, and personal loans with no increase in fee.

To qualify, you must start with a student loan.

Ready to Enroll?

You’ve got two options: Online or By Phone

For both options, you’ll need:

- Bank Information: account & routing numbers, + login credentials

- Loan Information: most recent statement

Phone enrollment (888) 905-0155 M – F 6:00 – 6:00 PST

No Credit Card Required to Enroll.

Disclosures

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

²This is a limited time offer for those with Student Loan debt. This offer has no cash value. Offer is subject to change with notice.