Automate Financial Planning

Nearly 3 million people have used our automation tools to pay debt down faster, save thousands on interest, and improve their financial stability.

Enrollment takes about 7 minutes. Details below.

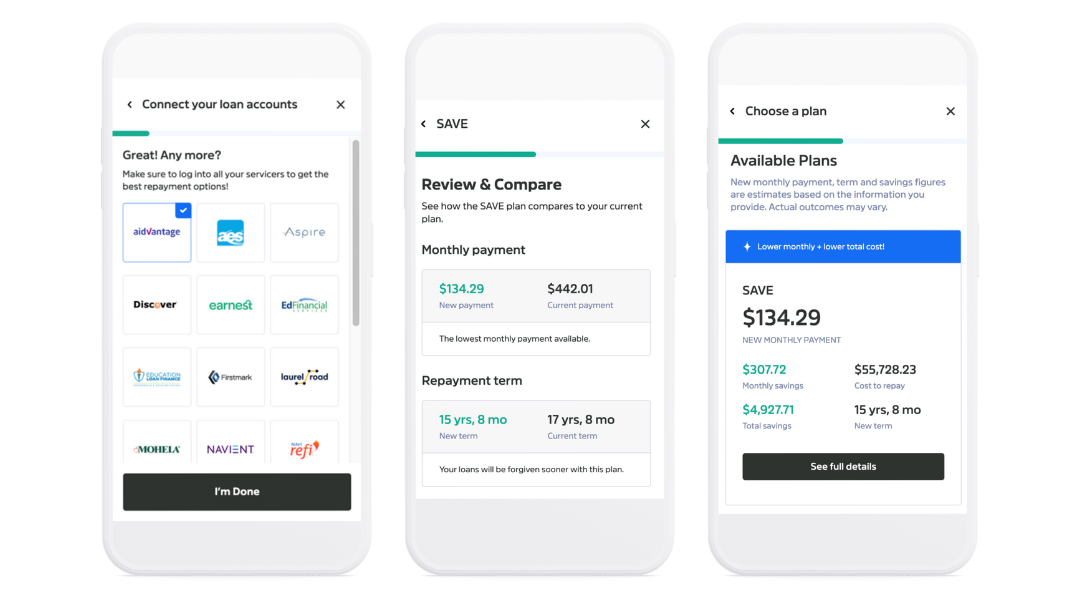

Student Loan Debt Tools that Get You to Your Goals Faster

Your education should move you toward your financial goals, not prevent you from reaching them.

- Locate open student loans and servicers

- Assess eligibility & apply for Federal student loan savings plans

- Get paydown scenarios & create a personalized payment plan

- Use EarnUp to put payment plan on autopilot

- Optional acceleration program fast tracks payoff & saves on interest fees

Ready to Buy a Home?

Credit Card Debt Holding You Back?

A Simple Way to Reach Your Financial Goals

We can help you get to your financial goals easier and faster.

That can include building emergency savings, paying down high interest rate debt, or accelerating the payoff of student loans, mortgage, personal, or auto loans.

The best part is you can begin to see results fairly quickly.

Programs Information & Overview

EarnUp can help participants throughout every phase of their financial life.

In fact, EarnUp customers use our services for an average of 14 years.

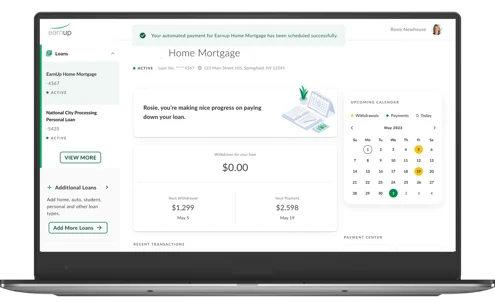

Enrollment is similar to setting up autopay with your bank.

During enrollment you'll be asked for the following:

- Bank Information: account & routing numbers for debits

- Loan Information: most recent statement to confirm loan and loan payment details

Calculate Your Potential Savings

Estimate interest savings and loan payoff acceleration on a bi-weekly schedule. Your actual savings will differ.*

Note: There is no change to interest rates or loan terms. This is not a debt consolidation tool.**

* EarnUP will waive your monthly $10.00 Program fees for the first 6 months following the first debit. Limited one-time offer for Prosper Wise Participants only. This offer has no cash value and is subject to change or cancellation.

**Interest and loan term reduction are net of EarnUp’s Program fees and are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Copyright © 2024, EarnUp Inc.